What is cryptocurrency? In recent times, it has evolved from an experimental technology into a major financial breakthrough. Whether you’re a tech enthusiast, investor, or simply curious about the future of finance, understanding this digital revolution is more important than ever. At its core, cryptocurrency is a decentralized form of digital currency that’s reshaping how we think about money. This blog breaks down the basics of cryptocurrency and explores its potential impact on the global economy.

What Is Cryptocurrency?

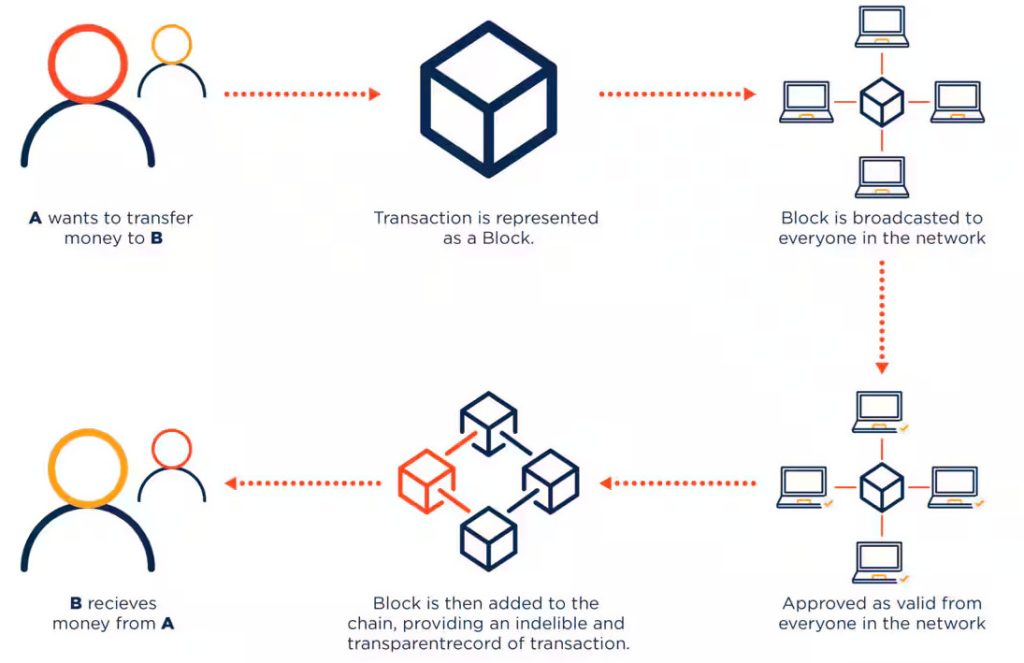

Cryptocurrency is a form of digital or virtual currency that uses cryptography for cover. Unlike traditional currencies published by governments (also called edict money), cryptocurrencies work on decentralized networks grounded on blockchain technology. A blockchain is a distributed tally applied by a network of computers, constantly called bumps.

The most well- grasped cryptocurrency is Bitcoin, which was introduced in 2009 by an incognito person (or group) under the alias Satoshi Nakamoto. Since also, thousands of other cryptocurrencies analogous as Ethereum, Litecoin, and Solana have been developed for various operations.

How Does Cryptocurrency Work for Beginners?

At its core, cryptocurrency involves a numerous pivotal component

Blockchain Technology: A decentralized count that records all deals across a network of computers. This makes data fixed and clear.

Mining and Validators: In evidence- of- work systems (like Bitcoin), miners solve complex fine puzzles to validate deals. In evidence- of- stake systems (like Ethereum 2.0), validators are chosen based on their holdings to approve deals.

Wallets: Digital wallets store cryptocurrency securely and allow users to send or receive funds using public and private keys.

Crypto Advantages and Risks You Should Know

Advantages of Cryptocurrency

Decentralization: No single establishment controls the cryptocurrency network, reducing the trouble of corruption or centralized crashes.

Security: Blockchain’s cryptographic nature makes it very delicate to alter transaction data.

Lower Transaction: Costs Cross- border payments can be made faster and cheaper than traditional banking systems.

financial Addition: People without access to traditional banking can use cryptocurrencies via a smartphone and internet connection.

Challenges and Risks

Volatility: Cryptocurrency prices can be extremely changeable, making them serious investments.

Regulation: multitudinous governments are still developing frameworks to regulate cryptocurrencies, which can create legal uncertainties.

Scams and Fraud: Due to its anonymous nature, crypto is occasionally used for lawless activities or subject to scams.

Environmental Concerns: evidence- of- work mining consumes significant amounts of electricity.

Cryptocurrency Use Cases

Investment and Trading: Crypto is often used as an asset for academic trading.

Smart Contracts: Platforms like Ethereum enable decentralized applications(dApps) and smart contracts that run without mortal intervention.

Remittances: People use crypto to send money across borders quickly and at lower fees.

NFTs (Non-Fungible Tokens): These are unique digital assets that are bought and sold using cryptocurrency.

How Do Cryptocurrencies Gain Value?

One common question after asking “what is digital currency?” is understanding how its value changes. Like traditional assets, cryptocurrency gains value based on supply and demand, market sentiment, utility, and investor speculation. Some cryptocurrencies are scarce by design—Bitcoin, for example, has a fixed supply of 21 million coins—which can drive up value as demand increases.

Another factor in how cryptocurrency gains value over time is its real-world use. Coins that support decentralized applications, smart contracts, or cross-border payments tend to attract more users, which increases demand. As adoption grows and blockchain technology continues to evolve, many experts believe that crypto assets will hold long-term value similar to traditional investments.

The Future of Digital Money

Cryptocurrency is no longer just a buzzword it’s influencing how we think about money, ownership, and technology. As blockchain technology matures and regulation becomes clearer, we may see broader adoption in everyday life. Central banks are also exploring Central Bank Digital Currencies (CBDCs), which may blend the benefits of crypto with the stability of traditional currency.

While the future is still unfolding, one thing is clear digital assets is here to stay, and it will continue to play a major role in shaping the digital economy.

Conclusion

Cryptocurrency represents a new era in the evolution of finance — decentralized, digital, and democratized. Whether you’re planning to invest, build, or simply understand this emerging space, staying informed is pivotal. As with any financial decision, do your own research, assess risks, and keep learning.

Frequently Asked Questions (FAQ) —

What is the simplest explanation of digital currencies?

Cryptocurrency is a digital currency that operates on decentralized blockchain technology. It allows for secure, peer-to-peer deals without the need for banks.

Is cryptocurrency safe to invest in?

Cryptocurrency can be secure if you use trusted platforms and store your funds in secure wallets, but it remains a high-risk investment due to volatility.

What is the future of cryptocurrency?

Experts believe cryptocurrency will continue to evolve, with more real-world use cases, improved regulation, and potential integration with national digital currencies.

How do cryptocurrencies gain value?

Crypto gains value through supply and demand, real-world utility, scarcity (like Bitcoin’s limited supply), and market speculation.

-Written by Sanhita Dawn

Leave a Reply